This is one of the first questions people ask when they are looking to participate in financial markets. It’s right up there with “what should I invest in”? Of course, the adage “time in the market beats timing the market” holds true, but if we can squeeze some extra returns out of our investments, why wouldn’t we?

Firstly, the approach and answer will depend on the type of strategy you are investing into. If the strategy is systematic, we can utilise a statistical methodology. Take one of the trend-following strategies we trade in the Frame Long Short Australian Equity Fund as an example. It has been extensively tested over 20+ years of data to prove it is robust and can deliver strong risk adjusted returns over the long-term.

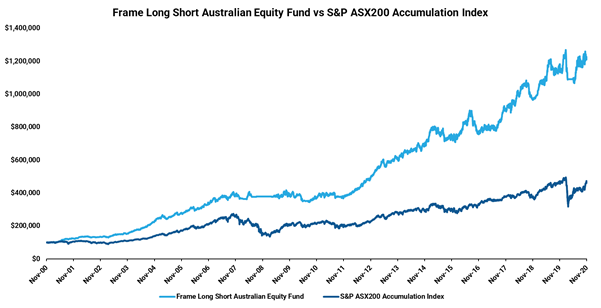

The chart below shows the hypothetical growth of $100,000 invested in December 2000 until December 2020. The back test shows the strategy to have an annualised return of 13.11% and a maximum drawdown of 17.33% for the period – very respectable performance statistics.

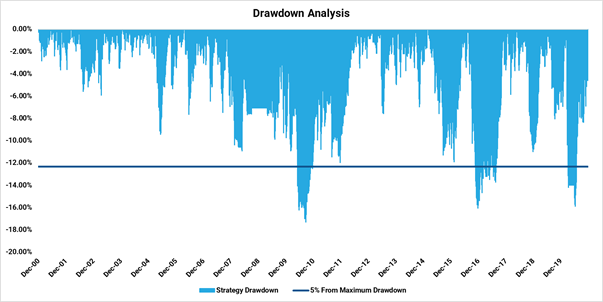

Now, given we know the theoretical ‘maximum’ loss of the system, it would make sense to increase the amount we invest as the strategy nears that level. Theoretically, we would invest more at a lower unit price, which ideally would capture more of the recovery. If we were to increase our investment by 10% every time the strategy dipped -12.33% from its peak, what impact would this have on the long-term annualised performance.

As we can see, you would be making additional investments in 2010, 2016 and 2020. With just three extra ‘top-ups’, your annualised rate of return becomes 13.56%, an additional 0.45% every year!

While this simple calculation introduces an aspect of ‘look ahead’ bias, it demonstrates the benefits of increasing your exposure at an opportune time. Importantly, you are still investing with a ‘time in the market’ approach, letting the positive expectancy of the strategy play out over the long term.

*Strategy run in a simulated environment; past performance is not a reliable indicator of future performance.