Implications

The US Dollar (USD) is the most influential currency on earth and its relative strength or weakness has far-reaching implications for the global economy. This piece will discuss why we are bullish on the USD and potential trades that may benefit as a result.

What is causing strength in the USD?

The United States economy has rapidly recovered from the COVID-19 pandemic, aided by the unprecedented level of stimulus from the US government and the Federal Reserve. Inflation and production data have continued to signal increasing strength in the US economy, which prompted the Federal Reserve to bring forward its timeline for increasing interest rates.

Money has flowed into the USD, as investors have positioned themselves in anticipation of the comparatively higher rate of return being offered sooner than expected. The Federal Reserve’s tightening timeline is also shorter than its European and Japanese counterparts.

Implications of USD strength?

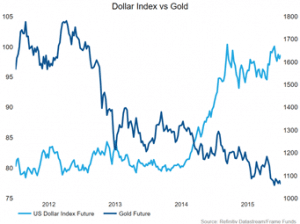

The US dollar is usually negatively correlated with commodity prices, meaning as the dollar increases in value, commodity prices decline. This is because commodity prices around the world are predominantly quoted in USD – a stronger USD means commodities are more expensive in terms of other currencies. This leads to lower demand and therefore lower prices. While the supply and demand for the underlying commodities have a major impact on prices, a strong dollar may put a dampener on commodity prices.

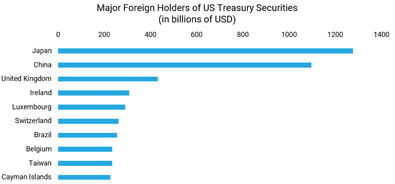

Emerging markets also suffer when the US dollar gains in value. Emerging economies like Brazil have high levels of exposure to US debt and when the Real is devalued relative to the dollar, the monetary value of debt increases. This means more money is diverted out of emerging economies to service their debt obligations, which results in slower economic growth.

Australian exporters to the US will also be beneficiaries of a stronger USD. Their goods and services become less expensive in US dollar terms and are therefore more attractive in the US market.

Similarly, Australian-based companies that have a substantial amount of business in the United States will report better in Australian Dollar terms. A weaker AUD/USD relationship will mean US-based earnings are higher when converted into Australian dollars.

Trade ideas

- Short gold – gold and the US dollar tend to have a strong negative correlation. As the US economy continues to recover and the Dollar appreciates, we would expect gold to decline in value. From September 2012 to January 2015 when the Dollar Index rose 18.71%, gold sold off 21.82%. During that time, the Federal Reserve had begun winding back its quantitative easing program that supported the economy throughout the GFC. We expect to see a similar environment in the next few years with the Fed slowly becoming more hawkish as the economy recovers.

- Short emerging markets – as debt burdens in countries like Brazil increase, we expect their economy to be adversely impacted. This should lead to slower growth and increased volatility in the benchmark Bovespa Index.

- Long ASX listed companies that do significant amounts of business in the US. James Hardie Industries (ASX:JHX), Mayne Pharma (ASX:MYX) and Aristocrat Leisure (ASX:ALL) generate 80%,85% and 66% of their revenue in the United States respectively. The earnings of these companies will be inflated with a stronger US Dollar and should appreciate commensurately.

- Long exporters to the US – companies that export to the United States will have their products appear cheaper in USD terms. BlueScope Steel (ASX:BSL)exports steel into the United States and should see a boost in sales as their product becomes less expensive for its North American Operations.

Conclusion

As the United States economy strengthens and the recovery from the pandemic continues, we are see ingan increasing number of similarities to the post-GFC recovery which occurred during 2012. Some of these include a more hawkish Federal Reserve, the effects of fiscal stimulus finally flowing through the economy and a stronger US dollar. We believe the similarities from the period mentioned above are far from over, and expect the US Dollar to continue to rise in the coming months and years. This appreciation may hinder extreme commodity price rises whilst also impacting some emerging markets. We also expect the earnings of Australian companies who do business in and export to the United States to benefit from this theme.

Download the full report by clicking the image below.