Weekly Update | 7th March 2025

1. Trump slaps 10% Tariff on all imports, sparking Global backlash

Last Wednesday, President Trump announced a 10% baseline tariff on all U.S. imports, effective April 5th with higher reciprocal rates (up to 50%), which targeted 57 countries, which included China (34%) and the EU (20%) starting April 9th. Aimed at boosting U.S. manufacturing, the move triggered a stock market plunge and retaliation threats from Canada and China. Economists warn of inflation spikes and recession risk by year-end.

2. RBA Holds Cash Rate at 4.1% amid easing inflation

The Reserve Bank of Australia kept the cash rate at 4.1% in March, noting that underlying inflation continues to moderate from its 2022 peak. Despite a tight labour market, and high unit labour costs, demand weakness limits price pass-through. The RBA remains cautious, as they prioritise a sustainable return to the 2-3% inflation target. Global uncertainties, like U.S. tariffs add risks, policy is expected to stay restrictive to balance growth and price stability.

3. U.S. jobs surge by 228k, Unemployment steady at 4.2%

U.S. nonfarm payrolls grew by 228k in March, beating the 12-month average of 158k. Health care (+54k), social assistance (+24k), and retail trade (+24k, boosted by strike returns) led gains. The unemployment rate held at 4.2%, with 7.1 million unemployed. Hourly earnings rose 3.8% year-over-year to $36.00. Despite revisions cutting January-February jobs by 48k, the labour market remains robust amid cooling inflation pressures, which should be viewed positively by the US Fed.

4. Canada shed -33k jobs, Unemployment climbs to 6.7%

Canada’s employment dropped -33k (-0.2%) in March, which pushed the unemployment rate to 6.7%, up 0.1 points. Losses hit older men (-21k) and sectors like wholesale/retail (-29k) and culture/recreation (-20k). Hours worked rose 0.4%, while wages grew 3.6% to $36.05 year-over-year. Gains in Utilities (+4,200) offered some offset to the broader decline. These figures will be viewed cautiously by the Bank of Canada, as they assess the future health of the Canadian Economy.

5. U.S. Manufacturing slips back into contraction at 49%

U.S. manufacturing contracted in March, with the PMI at 49%, down from 50.3% in February. New orders (45.2%) and production (48.3%) weakened, employment fell to 44.7%, and backlogs shrank. Prices surged to 69.4% amid tariff pressures which boosted inventories (53.4%). Demand softened, exports dropped to 49.6%, and 46% of manufacturing GDP contracted, which signalled economic headwinds due to Tariffs.

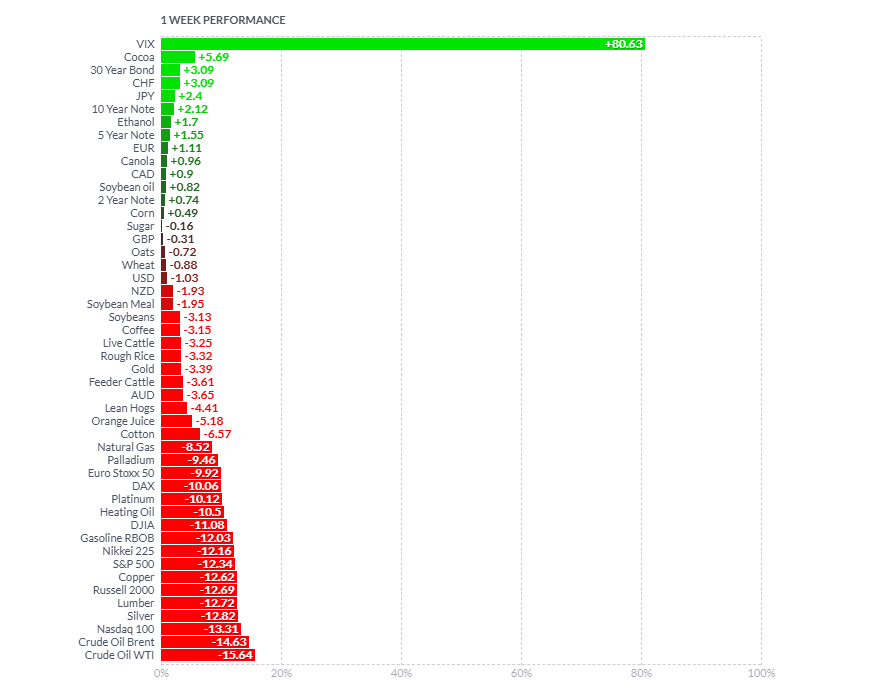

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

There are two main things to focus on here. 1. The performance of the VIX as we have finally seen some buying of protection. This upward movement in the VIX is what we would have expected with the Nasdaq down around –25% from highs. 2. The broad selling pressure across numerous commodity contracts, as investors assess if the tariffs wars will impact the supply/demand dynamic over the upcoming months. The Oil complex was sold off aggressively with Trump trying to aggressively drag oil prices down to improve the situation with inflation.

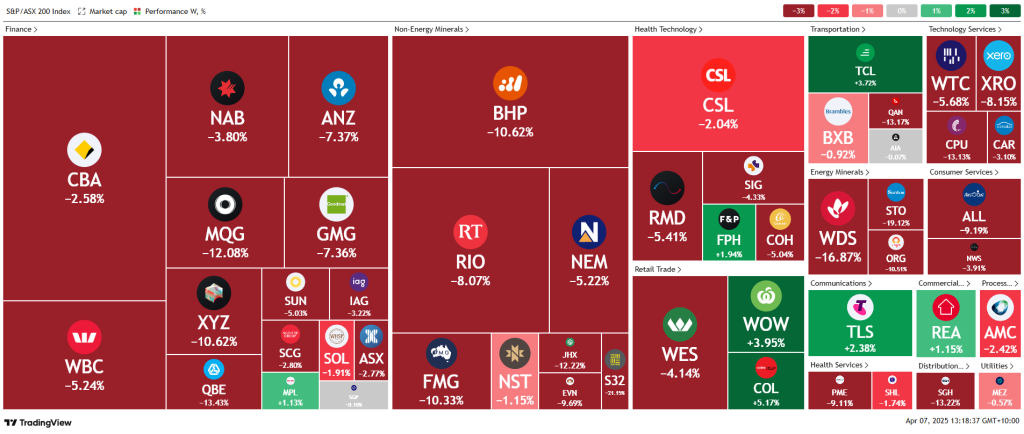

Here is the week’s heatmap for the largest companies in the ASX.

What a week, and start to the year for that matter. Last week was another bruising for the Australian share market as investors pulled money from businesses listed on the ASX. There were a few very small bright spots, such as WOW, COL, TLS and TCL. Some reported results and provided news updates, while others had no specific catalysts. On the downside, we saw the selling of materials accelerate, most of this occurring on Friday and today. The acceleration was on the back of the Australian share market selling off aggressively, while also in response to China’s retaliation to the US trade tariffs, with some of their own. BHP, RIO and FMG were all down over –8%. MQG had a shocker of a week, as their share price dropped by –12%, their underperformance was mainly a by-product of them conducting significant business in the US.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.