Weekly Update | March 1, 2024

If you would like to watch this update rather than read it, please click the video below!

1. US CB consumer confidence slumped to 106.7

Confidence of American consumers has eased as the election season gets into gear. After four consecutive better than expected results, the CB consumer confidence stuttered to 106.7 from the previous downward revision of 110.9. This caught markets off guard, having bet on a stronger vote of confidence of 114.8. Political uncertainty, geopolitical risk, automation and social polarization largely underlying the fall in consumer confidence.

2. Australia’s CPI held static at 3.4% y/y

Inflationary pressure in Australia is thawing at an ever-increasing pace and ahead of schedule. CPI in the year to December reported at 3.4%, maintaining the previous figure, while undershooting market expectations of 3.6%. This goes a long way to demonstrate the restrictive effects that the current high interest rates are having on inflation.

3. New Zealand left interest rates unchanged at 5.5%

The RBNZ sat on its hands to leave interest rates unchanged for a fifth consecutive meeting. The central bank maintained the official cash rate at 5.5%, which was set in May last year, a move well anticipated by markets. The overall cooling of inflationary pressure as well as the now widely held perception that high interest rates are restricting demand largely underpinned the decision to hold.

4. US preliminary GDP faltered to 3.2% q/q

The US economic activity for the last quarter was lower than previously estimated. The preliminary GDP figure the final quarter of 2023 came in at 3.2%, a marginal reduction from the previous final GDP figure of the third quarter, which markets had expected. The inference is that restrictive monetary policies are working their way into the economy by limiting overall growth.

5. Canadian GDP stagnated at 0.0% in December

The Canadian economic slowdown is more apparent than previously estimated. The GDP growth for the month of December stagnated at 0.0%. This was a decline from the previous reading of 0. 2%. It is now very evident that high interest rates are stifling economic output.

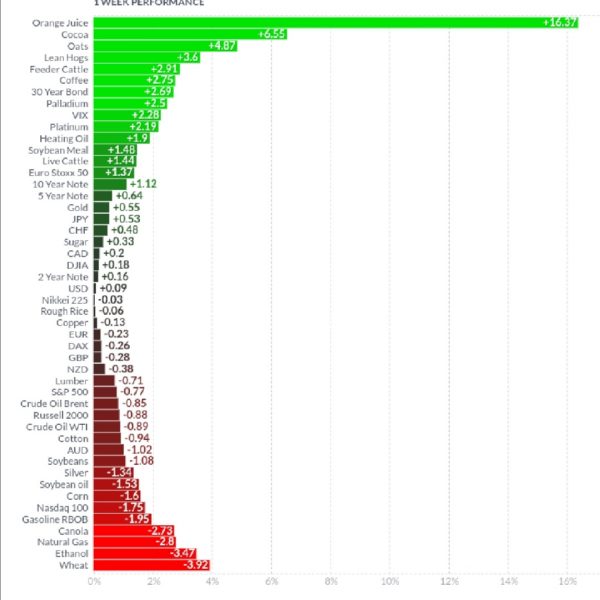

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Cotton, cocoa, oats, natural gas, coffee and lumber were top performers for the week as wetter and colder than expected conditions persisted, spiking seasonality driven demand. The VIX slumped from last week’s elevated level to be the worst performer for the week as markets significantly discounted geopolitical risk arising from the Middle East debacle after a quieter than usual week on that front. Global indices were boosted as investors returned to the table with the Russell 2000 leading the pack with a +2.04% gain. The energy complex remained hot on supply chain disruptions as well as the emerging estimates that combustion engines and demand for petroleum is likely to remain strong deep into the future. Orange juice suffered seasonality driven demand shortfalls while sugar and rice fell on better than expected harvest forecasts.

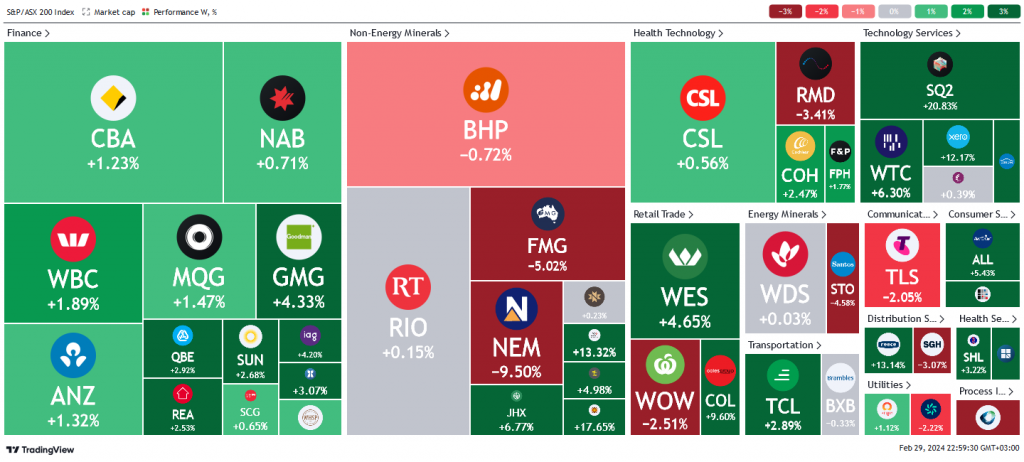

Here is the week’s heatmap for the largest companies in the ASX.

Another mixed but relatively bullish week for the ASX. Financials stood out as the best performers to blow on all cylinders with all stocks in the green. The bullish run in the sector was buoyed by lower than expected inflation data and markets heavily discounting prospects of another interest rate hike in the near term. GMG and IAG led the charge to close >4.2%. Non miners were mixed with a bias to the upside. NEM outsold the index to close – 9.5% down while bullish activity was most notable in PLS and MIN which were in overdrive with massive +17.65% and 13.32% rises respectively. Health tech stocks were largely bullish with RMD the only exception. This was replicated in the retail trade sector where all but one stock was in profits. On the other hand, tech services stocks were all green without exceptions.

Another mixed but relatively bullish week for the ASX. Financials stood out as the best performers to blow on all cylinders with all stocks in the green. The bullish run in the sector was buoyed by lower than expected inflation data and markets heavily discounting prospects of another interest rate hike in the near term. GMG and IAG led the charge to close >4.2%. Non miners were mixed with a bias to the upside. NEM outsold the index to close – 9.5% down while bullish activity was most notable in PLS and MIN which were in overdrive with massive +17.65% and 13.32% rises respectively. Health tech stocks were largely bullish with RMD the only exception. This was replicated in the retail trade sector where all but one stock was in profits. On the other hand, tech services stocks were all green without exceptions.

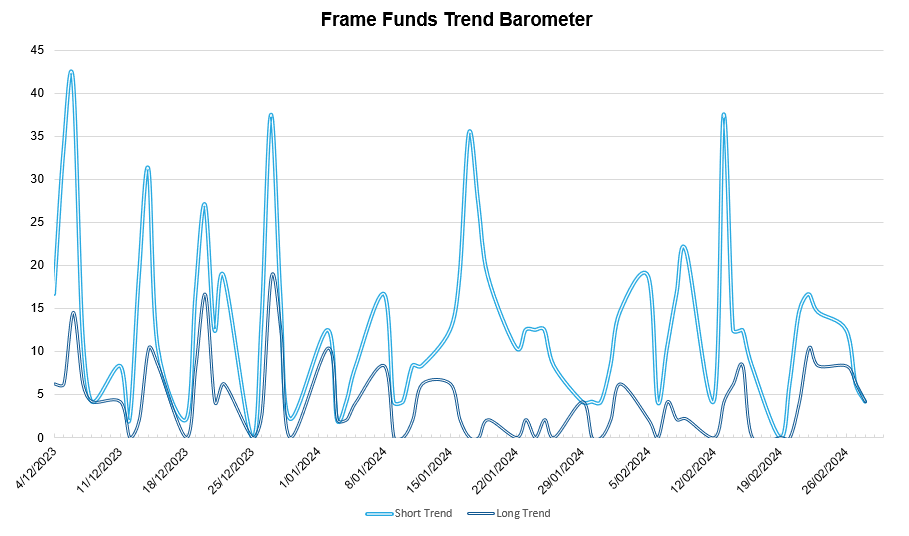

Below shows our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.