Weekly Update | 12th May 2025

1. US ISM services PMI expands to 51.6 vs 50.2 expected

The U.S. services sector expanded in April, with the ISM Services PMI rising to 51.6, which surpassed expectations. This marks the 10th consecutive month of growth, driven by increased new orders at 52.3. However, the employment index remained in contraction at 49.0, and input prices surged to 65.1, indicating inflationary pressures. While the sector shows resilience, persistent inflation and labor market softness could challenge sustained growth.

2. NZ unemployment rate steady at 5.1%

New Zealand’s unemployment rate held steady at 5.1% in the March 2025 quarter, which aligned with the previous quarter. The employment rate dipped to 67.2%. These figures suggest a stabilising labour market, though the uptick in underutilisation may signal emerging slack, potentially influencing future monetary policy decisions.

3. US Federal Reserve leaves rates steady at 4.5%

The Federal Reserve maintained the federal funds rate at 4.25%-4.5%, citing concerns over rising inflation and unemployment risks, partly due to tariff impacts. While the economy showed solid expansion, the Fed adopted a cautious stance, awaiting clearer economic signals before adjusting rates, with potential cuts projected later in the year.

4. US unemployment claims steady at 228K

Initial U.S. unemployment claims were 228,000, slightly below the forecast of 231,000. This stability indicated a resilient labour market despite broader economic uncertainties. However, ongoing monitoring is essential as external factors, like trade tensions, could influence employment trends and the stance of the US Federal Reserve over the next 6 months.

5. China & US hold trade talk s which go positively

Recent U.S.-China trade talks in Geneva yielded “substantial progress,” with both nations considering tariff reductions. A joint statement arrived this morning which eased tensions from prior tariff escalations. This development could stabilise global markets and supply chains, offering a more optimistic outlook for international trade relations.

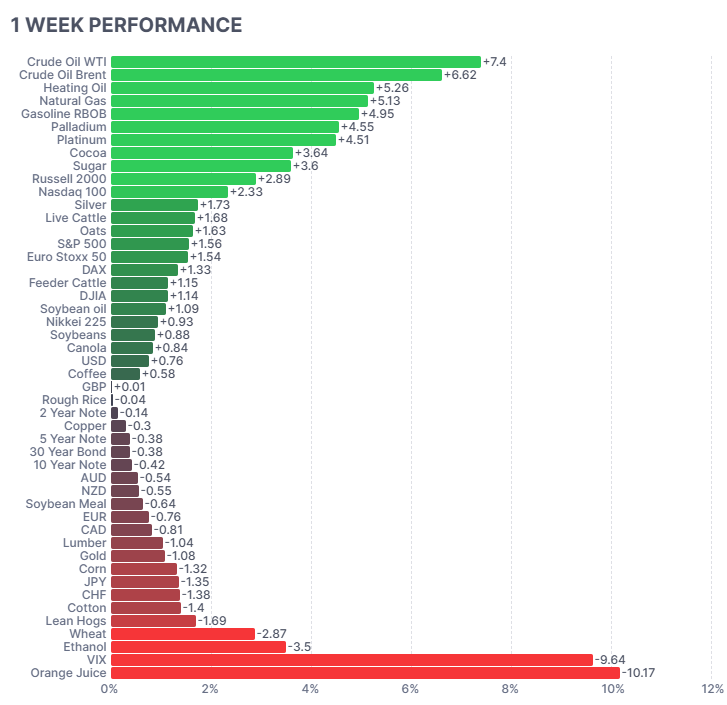

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

The Energy complex had a solid week, with Crude, Brent, Heating Oil, Natural Gas and RBOB all jumped > +4.5%. The catalyst for this was the trade news between the US and China as it expects to provide a more supportive global environment for growth. Equities jumped well, with the Russell 2000, Nasdaq and S&P500 all rising >+1.5%. The US Dollar Index also rebounded +0.75%, which seemed to drag on the price of Gold, which has recently been on an exceptional move higher. Gold was down -1.1%. Orange Juice saw profit taking, as it dropped -10.17%.

Here is the week’s heatmap for the largest companies in the ASX.

Last week saw continued volatility domestically, with the vast majority of this volatility coming from continued trade talks and local economic data. Financials experienced a week of profit taking after having a couple of solid weeks. NAB, WBC and ANZ were all down >-2.5%. Materials saw a reasonable week, with BHP, and RIO both rising ~+1%, however this was still somewhat lacklustre as they have been mediocre recently. CSL dropped -8.23% after worries about US tariffs hit home. XYZ was the best performer, as it rose +13.51%, which was a rebound following the prior weeks poor performance. Outside of this, the XJO continued to rise as market participants expect an additional rate cut next Tuesday. The talks between the US and China have also been a net positive for equities, with US futures showing a 1% jump higher this morning.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.