Weekly Update | 12th May 2025

1. US Core CPI m/m rises by 0.2% vs 0.3% expected

U.S. core inflation in April rose 0.2%, below the anticipated 0.3%, bringing the annual rate to 2.8%. This marks the third consecutive month of cooling inflation, despite recent tariff announcements. The moderation suggests the Federal Reserve may maintain current interest rates, though sustained tariffs could pose future inflationary risks.

2. Australian Wage Price Index q/q rises 0.9% vs 0.7% previous

Australia’s Wage Price Index increased by 0.9% in Q1 2025, up from 0.7% previously, with annual growth reaching 3.4%. Both private and public sectors contributed to this rise, indicating strengthening wage pressures. This uptick may influence the Reserve Bank of Australia’s monetary policy decisions amid ongoing inflation concerns.

3. China issues 280B in new loans

In April, Chinese banks extended 280 billion yuan in new loans, significantly below forecasts and a sharp decline from March’s 3.64 trillion yuan. The drop reflects weakened credit demand amid prolonged U.S.-China trade tensions, signaling potential challenges for China’s economic growth and prompting calls for policy support.

4. Australian add 89K new jobs vs 20.9K expected

Australia’s employment surged by 89,000 in April, vastly exceeding expectations. The unemployment rate remained steady at 4.1%, while underemployment edged up to 6.0%. This robust job growth underscores a resilient labor market, potentially impacting future interest rate considerations by the Reserve Bank of Australia.

5. US Core PPI m/m declines by -0.4% vs 0.3% expected

U.S. core producer prices fell by 0.4% in April, contrary to expectations of a 0.3% increase. The decline was primarily due to reduced service costs, suggesting easing upstream inflation pressures. While this may offer relief to consumers, ongoing trade policies could influence future price dynamics.

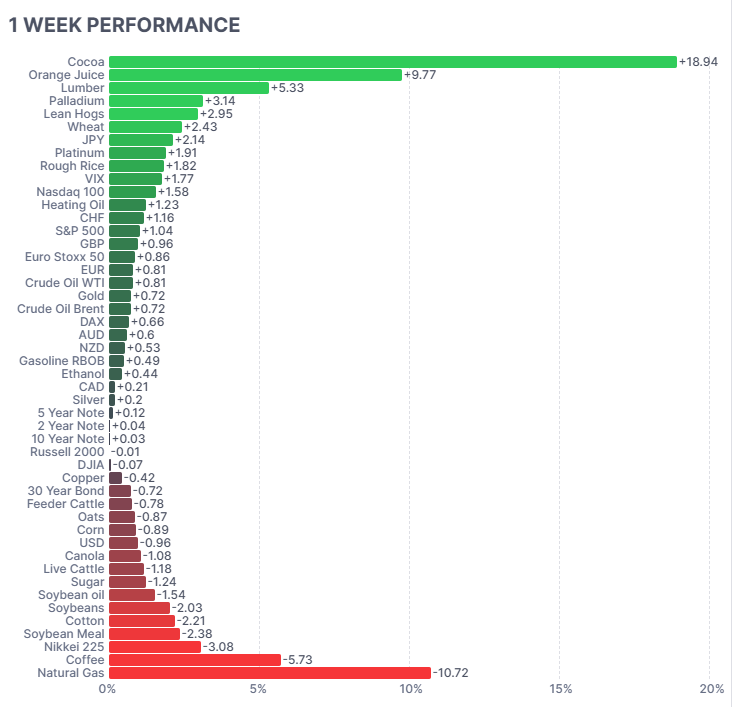

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Markets delivered a mixed performance last week, with commodities showing dramatic divergence. Cocoa led gains, soaring +18.94%, followed by orange juice (+9.77%) and lumber (+5.33%). Both these movements reflected ongoing supply shortages and weather disruptions. On the downside, natural gas plunged -10.72%, driven by mild weather forecasts and ample storage. Coffee and Japan’s Nikkei 225 also fell sharply.

Broad equity indices like the S&P 500 (+1.04%) and Nasdaq 100 (+1.58%) posted modest gains amid cooling U.S. inflation data. Wheat, palladium, and platinum saw renewed strength, while soybeans, corn, and cotton weakened, suggesting reduced demand expectations and improved crop outlooks.

Here is the week’s heatmap for the largest companies in the ASX.

Australian equities showed mixed sector performance, with standout gains in non-energy minerals and energy stocks. Heavyweights like BHP (+2.31%), RIO (+2.98%), and FMG (+3.22%) lifted the materials sector, buoyed by China’s renewed credit stimulus and optimism around commodity demand. Woodside Energy (WDS +5.89%) surged on stronger oil prices. In financials, CBA (+1.24%) and NAB (+2.13%) posted gains, but ANZ (-2.22%) and WBC (-0.67%) lagged, which reflected mixed sentiment post local wage and employment data. Tech outperformed broadly, led by WiseTech (WTC +4.63%) and Xero (XRO -6.28%), the latter under pressure from weaker forward guidance. CSL (+3.06%) supported health tech, while consumer stocks such as WOW (-3.46%), COL (-4.11%), and ALL (-5.81%) slumped, as a rotation into higher beta names occurred. Meanwhile, Commercial Services (XYZ +12.69%) and Auckland Airport (AIA +11.63%) outperformed strongly, reflecting investor rotation into infrastructure and travel-linked names.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.