Weekly Update | 10th June 2025

1. US ISM Manufacturing PMI contracts to 48.5

In May 2025, the ISM Manufacturing PMI fell to 48.5, marking the third consecutive month of contraction and the lowest reading since November 2024. The decline reflects ongoing challenges in the manufacturing sector, including reduced new orders and employment. Trade policy uncertainties and elevated input costs continue to weigh on production. This persistent contraction suggests that the manufacturing sector remains under pressure, potentially dampening overall economic growth.

2. US JOLTS expands to 7.39M

In April 2025, U.S. job openings unexpectedly rose to 7.39 million, up from 7.2 million in March, which indicates resilience in the labour market despite economic headwinds. Growth was notable in professional, business, education, and health services, while openings in hospitality and manufacturing declined. The quits rate remained steady at 2.0%, suggesting stable worker confidence. This uptick in job openings points to continued labour market strength, which may support consumer spending and economic stability.

3. Australian GDP slows as it rises 0.2% vs 0.4% expected

Australia’s GDP grew by 0.2% in Q1 2025, below the anticipated 0.4% and down from 0.6% in Q4 2024. The slowdown was attributed to weak household consumption, subdued government spending, and adverse weather affecting exports. Private demand provided some support, but overall growth remains sluggish. This deceleration may prompt the Reserve Bank of Australia to consider further monetary easing to stimulate the economy.

4. Bank of Canada held their overnight rate at 2.75%

On June 4, 2025, the Bank of Canada maintained its overnight rate at 2.75%, citing stronger-than-expected Q1 growth and ongoing trade uncertainties. The decision reflects a cautious approach amid fluctuating global trade policies and domestic economic resilience. The central bank emphasized the need to monitor economic developments closely. Holding the rate steady suggests confidence in current economic conditions while remaining vigilant to potential risks.

5. European Central Banks cut rates to 2.15%

The European Central Bank reduced its main refinancing rate by 25 basis points to 2.15%, which marked the eighth consecutive cut. The decision was driven by easing inflation, with eurozone inflation falling to 1.9% in May, and concerns over economic growth amid trade tensions. The ECB signaled that it may be nearing the end of its rate-cutting cycle. This move aims to support economic activity, but further policy adjustments will depend on upcoming economic data.

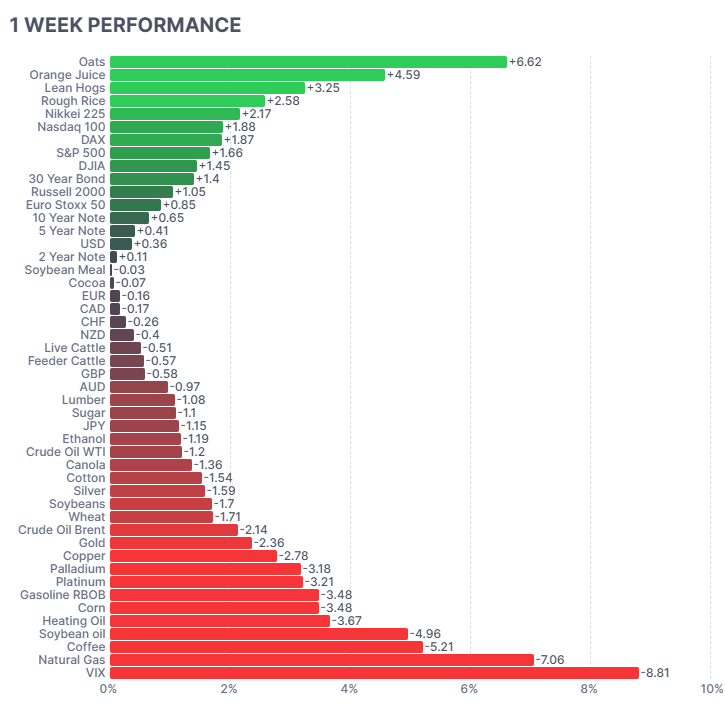

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Over the past week, commodities saw sharp gains in precious metals, with platinum (+14.91%), palladium (+7.05%), and silver (+6.63%) rallying on increased safe-haven demand amid global growth concerns and expectations of rate cuts. Coffee (+5.19%) rose due to tighter supply forecasts from Brazil. Energy markets rebounded, with WTI crude (+3.12%) and heating oil (+2.29%) gaining on rising summer demand. Bitcoin (+3.45%) also advanced, driven by improving investor sentiment. On the downside, Ethanol (-4.32%) and Cotton (-3.57%) dropped on weaker demand signals. VIX (-4.45%) declined, indicating lower market volatility expectations. Overall, markets reflected optimism in risk assets and strength in hard commodities.

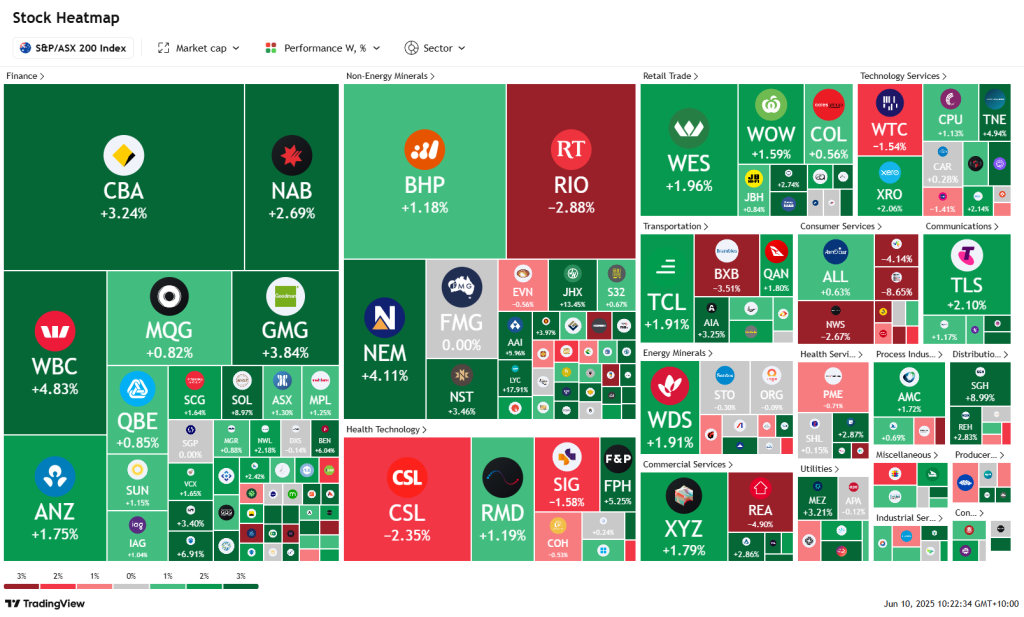

Here is the week’s heatmap for the largest companies in the ASX.

The ASX200 posted broad-based gains this week, led by mining stocks such as Lynas (+17.91%), Allkem (+13.45%), and IGO (+9.66%) on optimism around rare earth and lithium demand. Financials were strong, with WBC (+4.83%) and GMG (+3.84%) leading the pack as bond yields stabilised. Telstra (+2.10%) and Xero (+2.06%) supported tech and communications. Healthcare was mixed; CSL (-2.35%) lagged on cautious earnings sentiment. Notably, REA Group (-4.90%) and Aristocrat Leisure (-8.65%) fell on weaker consumer confidence. Overall, sentiment improved on rate cut hopes, commodity strength, and resilience in the banking and energy sectors. This broad buying behaviour has been shown to be very bullish for further upside on the ASX.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.