Weekly Update | November 24, 2023

Let’s hop straight into five of the biggest developments this week.

If you’d prefer to watch this update, rather than read it, please click below.

1. Canada’s trimmed CPI cooled to 3.5% y/y

1. Canada’s trimmed CPI cooled to 3.5% y/y

Inflation in Canada is thawing at a faster rate than expected. The trimmed CPI in the twelve months to October undershot the 3.6% market forecast to report at 3.5%, the lowest figure since December 2021, and a marked reduction from the previous 3.7%. The persistent decline in petroleum prices accounted for the bulk of the ease in inflationary pressure.

2. US revised UoM consumer confidence grew to 61.3

The US consumer base is heading into the festive season with renewed optimism about present and near-term business conditions. The 61.3 UoM survey final report for November came in as a significant improvement from the initial 60.4, surpassing expectations of 61.1. Despite confidence being at the lowest level since March after a series of restrictive policies, falling prices at the pump and cheap imports from China are injecting renewed optimism.

3. US unemployment claims fell to 209k

The US labour market took a breather after a series of poor statistics in recent weeks. The seasonally adjusted unemployment claims reduced for the first time since mid-October to 209k from the previous upwardly revised figure of 233k. This was a much better showing than market expectations of 226k, a sign that the festive frenzy could be setting in early.

4. Germany’s flash manufacturing PMI rose to 42.3

Activity in the German manufacturing sector sped up at a faster rate than had been forecasted by market participants, although it remained in contractionary territory since June 2022. November’s flash manufacturing PMI surged to 42.3 to mark the highest rate of activity since May. Falling petroleum and raw materials prices are notable contributors.

5. UK flash services PMI rose to 50.5 in November

The services sector in the UK expanded for the first time since July, growing faster than expected. The flash services PMI for November rose to 50.5 to beat expectations of 49.5. Seasonality and better pricing at the pump stand out as notable contributors to enhanced activity.

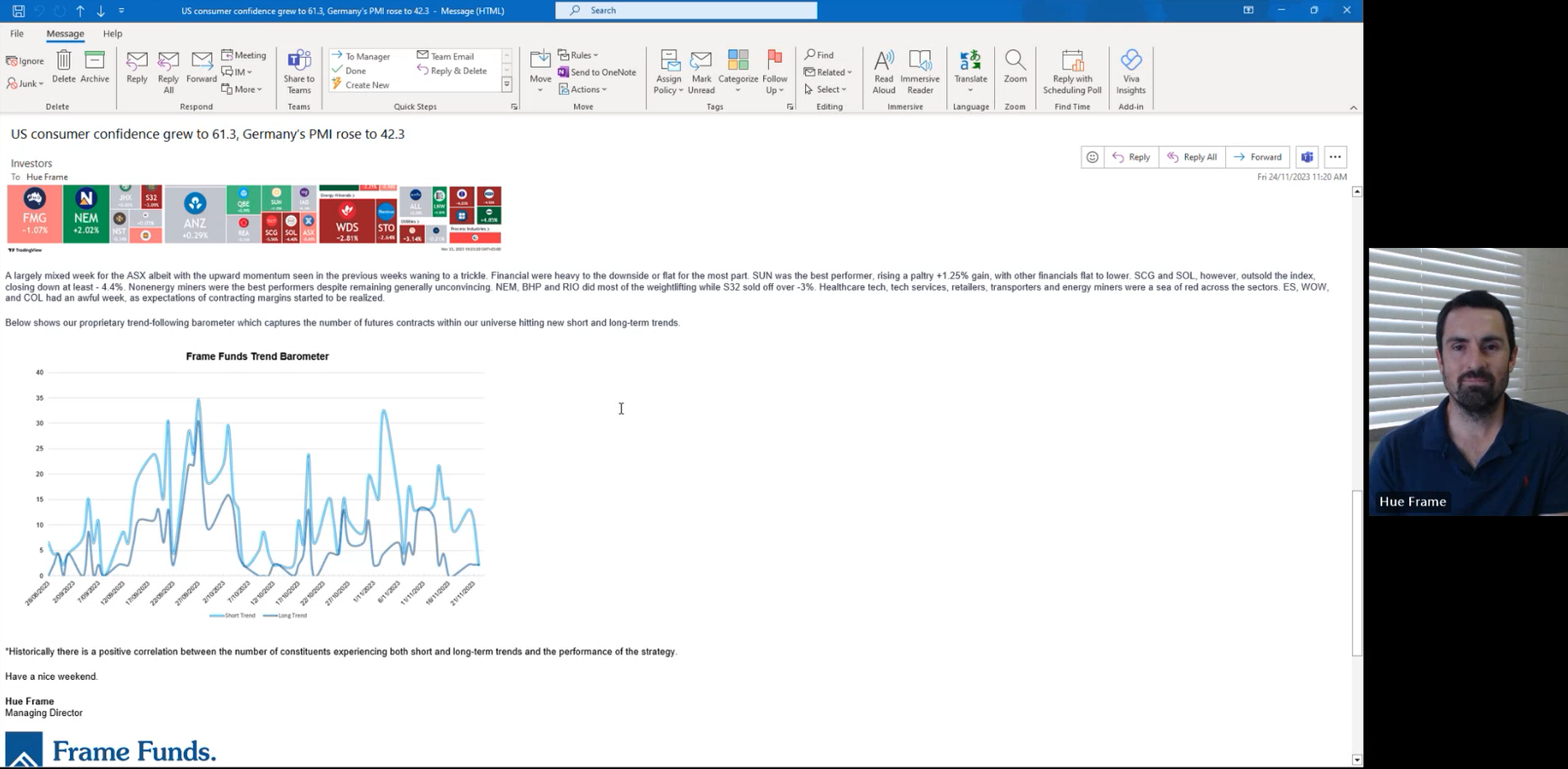

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

The energy complex rebounded from oversold levels after weeks of relentless selling pressure. The forthcoming OPEC+ meeting, where collective production cuts to mop up oversupply is expected, propped up prices to support a short-term recovery. Oats and orange juice were up on seasonality driven demand, as the festive season kicks in, while the rebound in construction in the US propped up lumber prices. On the other hand, slowing odds for further hikes as inflation cools off across the board prompted risk taking among market participants, depressing the VIX and treasuries while supporting global indices. Natural gas fell on oversupply as weather conditions improve, while lean hogs tapered on oversupply of feed as new grain comes in.

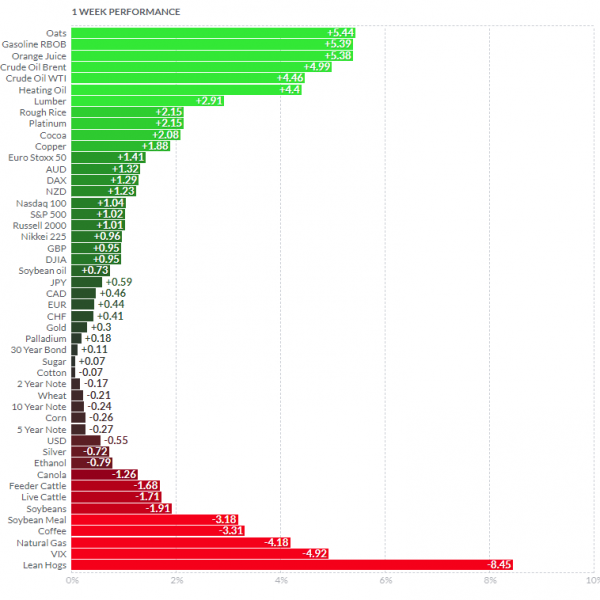

Here is the week’s heatmap for the largest companies in the ASX.

A largely mixed week for the ASX albeit with the upward momentum seen in the previous weeks waning to a trickle. Financial were heavy to the downside or flat for the most part. SUN was the best performer, rising a paltry +1.25% gain, with other financials flat to lower. SCG and SOL, however, outsold the index, closing down at least – 4.4%. Nonenergy miners were the best performers despite remaining generally unconvincing. NEM, BHP, and RIO did most of the weightlifting while S32 sold off over -3%. Healthcare tech, tech services, retailers, transporters, and energy miners were a sea of red across the sectors. ES, WOW, and COL had an awful week, as expectations of contracting margins started to be realized.

A largely mixed week for the ASX albeit with the upward momentum seen in the previous weeks waning to a trickle. Financial were heavy to the downside or flat for the most part. SUN was the best performer, rising a paltry +1.25% gain, with other financials flat to lower. SCG and SOL, however, outsold the index, closing down at least – 4.4%. Nonenergy miners were the best performers despite remaining generally unconvincing. NEM, BHP, and RIO did most of the weightlifting while S32 sold off over -3%. Healthcare tech, tech services, retailers, transporters, and energy miners were a sea of red across the sectors. ES, WOW, and COL had an awful week, as expectations of contracting margins started to be realized.

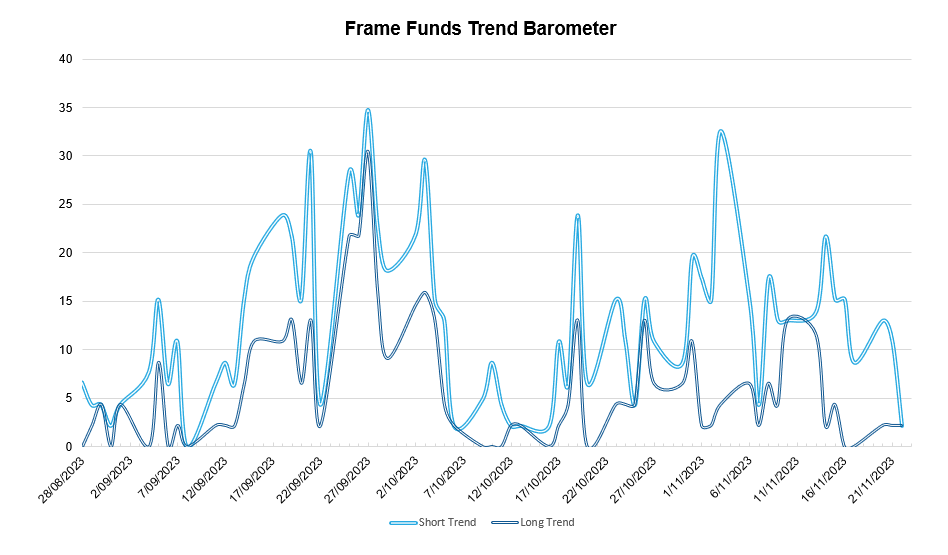

Below shows our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

*Historically there is a positive correlation between the number of constituents experiencing both short and long-term trends and the performance of the strategy.

*Historically there is a positive correlation between the number of constituents experiencing both short and long-term trends and the performance of the strategy.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.